The U.S. Casualty Market

Awards are Spiraling out of control and money trees are nowhere to be found.

In Summary

- The deterioration of 2015-2019 continues

- Nuclear verdicts are on the rise, litigation funding is fanning the flames

- Risk of bad faith is impacting insurers’ ability to manage the tide of claims

- Embedded auto exposures require further scrutiny

- 2020-2023 isn’t improving as much as hoped

- Limits and attachment points must be actively managed

- Casualty rates need to accelerate

If differences of opinion make markets, then U.S. casualty is in a healthy place as there are many conflicting views as to why 2015 to 2019 went so wrong. Are we on the right path now? Is it social inflation, out of control jurors, the legal system, third-party litigation funding, or simply under-pricing combined with careless limit deployment, followed by a very slow walk to recognize this?

To address these questions, we offer data points and insight from our perspective.

2015-2019 continues to deliver a slow, relentless beating to company results and, when you think the worst is over, another round of even harder hits begins. In late 2019, the tide turned and the market began to react to this predicament. The upshot was a sharp increase in premium, a tightening of limits, increased attachment points, as well as an inappropriate, and unsustainable, increase in reinsurance ceding commissions. The commission increases were both premature and too much, which can only be explained by giddy excitement of seeing the soft market cycle end.

To understand why we are still not celebrating, we must consider the underlying circumstances and drivers of casualty inflation.

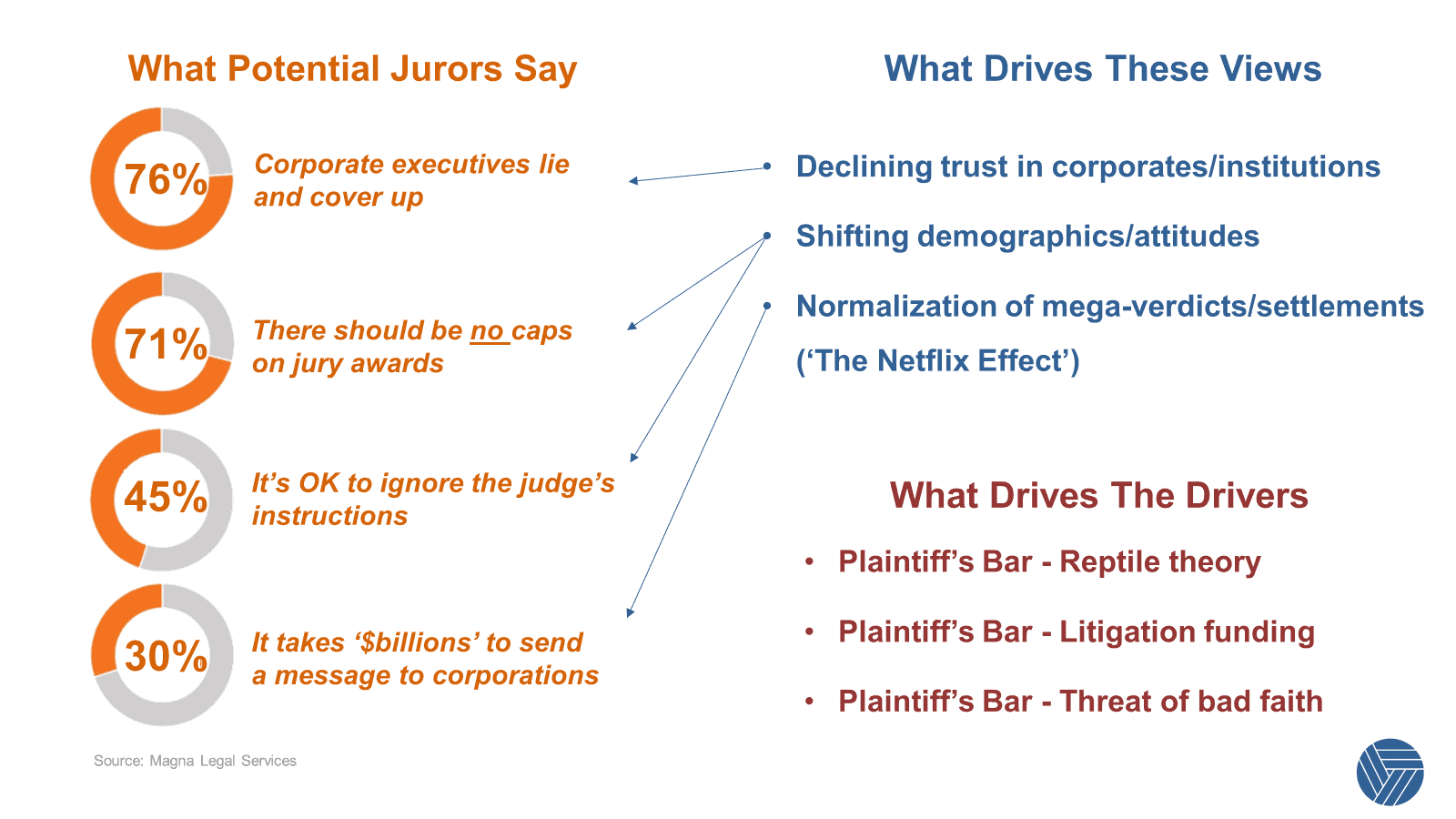

(Social Inflation is) “a broadening definition by society and juries of what is covered by insurance policies.”

Warren Buffett (1979)

No surprise that awards continue to increase at such a pace.

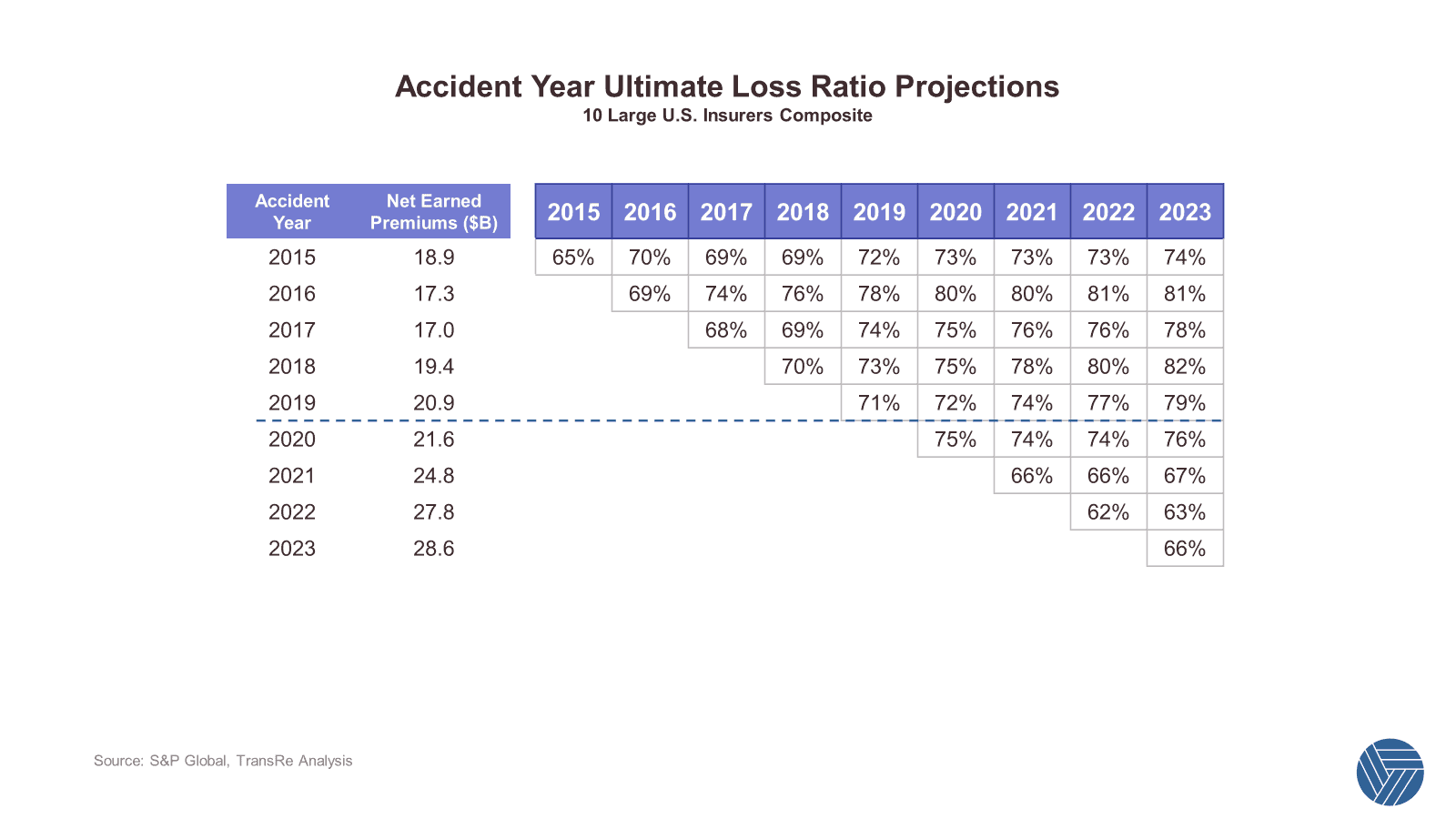

Social inflation can hide a multitude of sins, including under pricing and under reserving. Below is our composite view of accident year ultimate loss ratio projections for the ten largest U.S. casualty writers, as at 12/31/23:

In aggregate, these ten companies showed an average deterioration of 10% for the period 2015 to 2019. Put another way, total adverse development was $9.4B on $93.5B of premium income.

On first viewing, you would be forgiven for thinking this is a standard incurred loss progression chart. In fact, they are best estimate ultimate projections. When comparing initial assumptions against where they are today, it is hard to accept that this is all attributable to social inflation. Rather, it is evidence of a denial of soft market conditions.

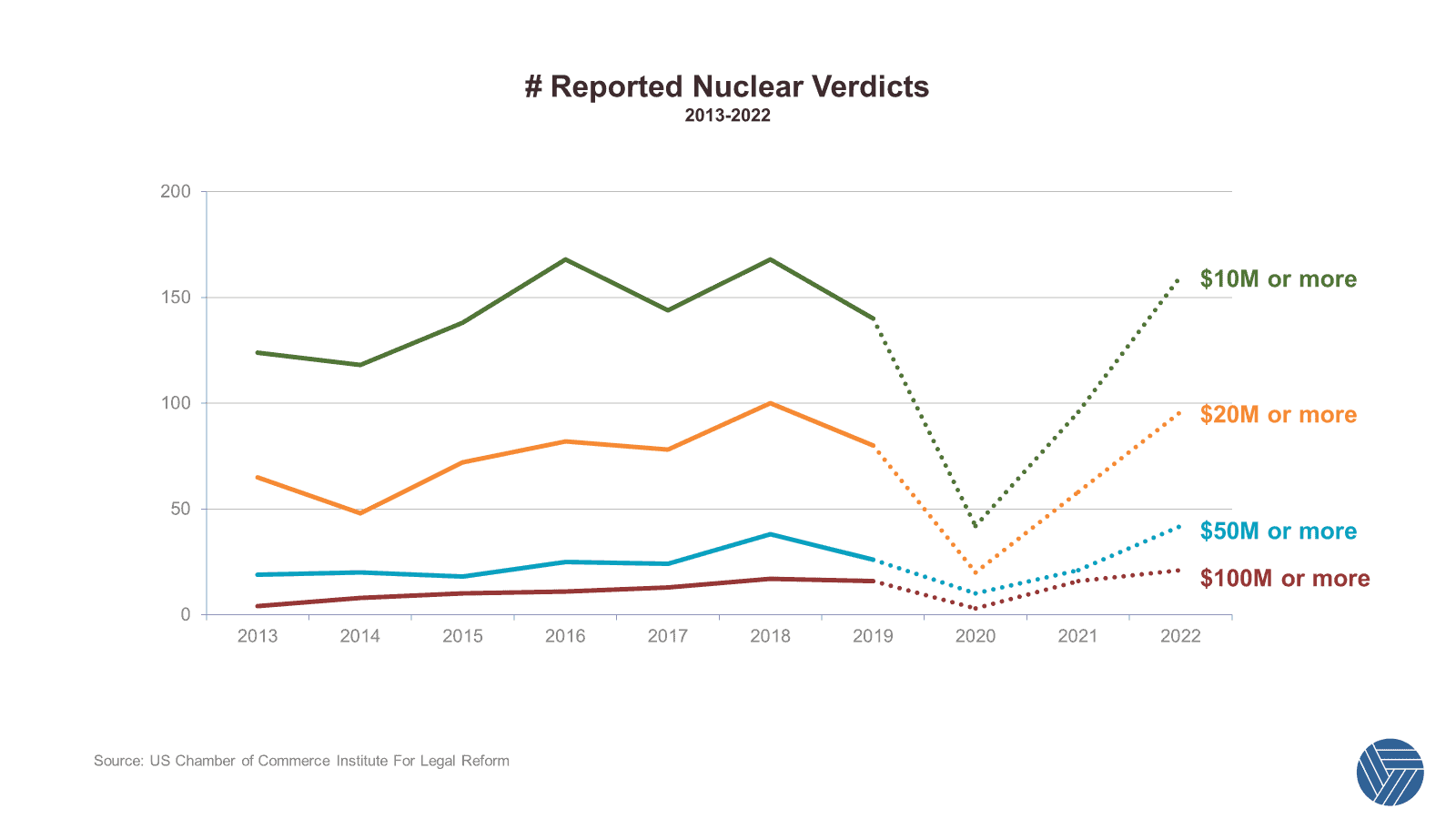

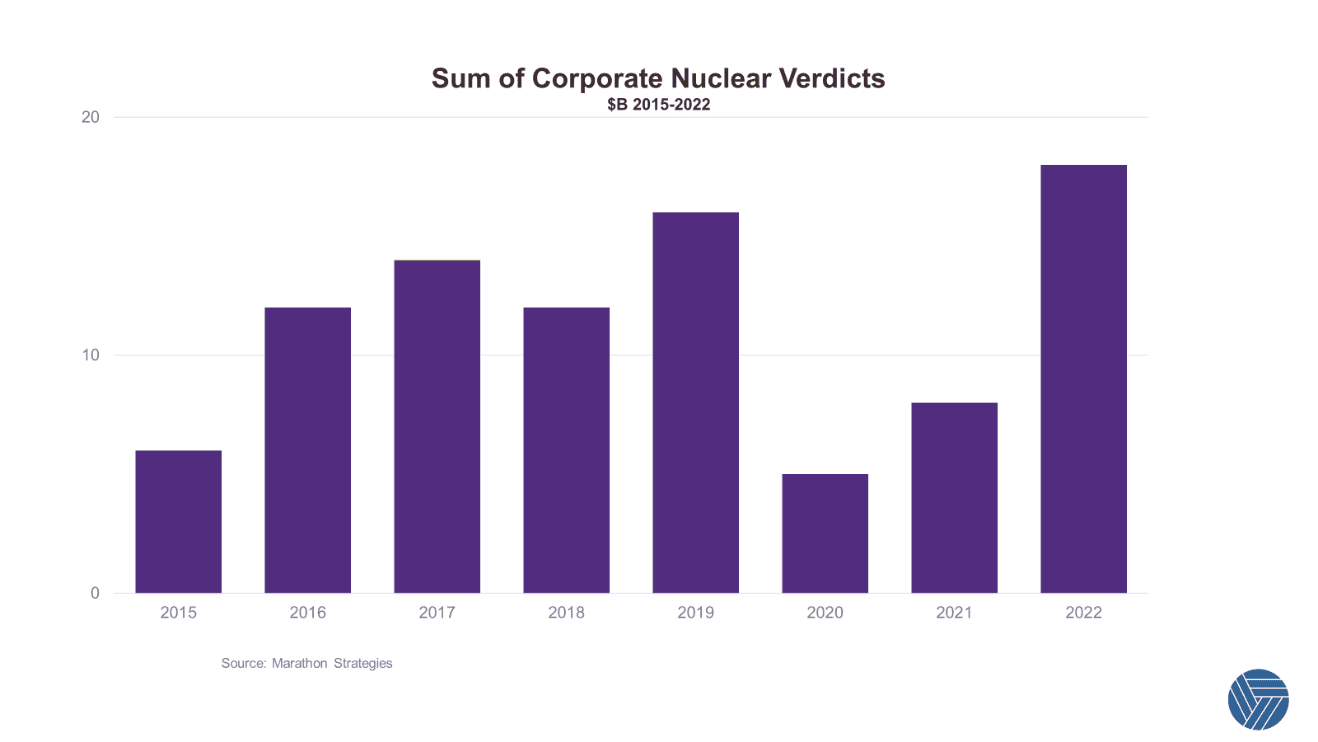

Nuclear Verdicts

Nuclear verdicts are routinely depicted as verdicts in excess of $10M, although this hurdle is already looking a little outdated, given current trends.

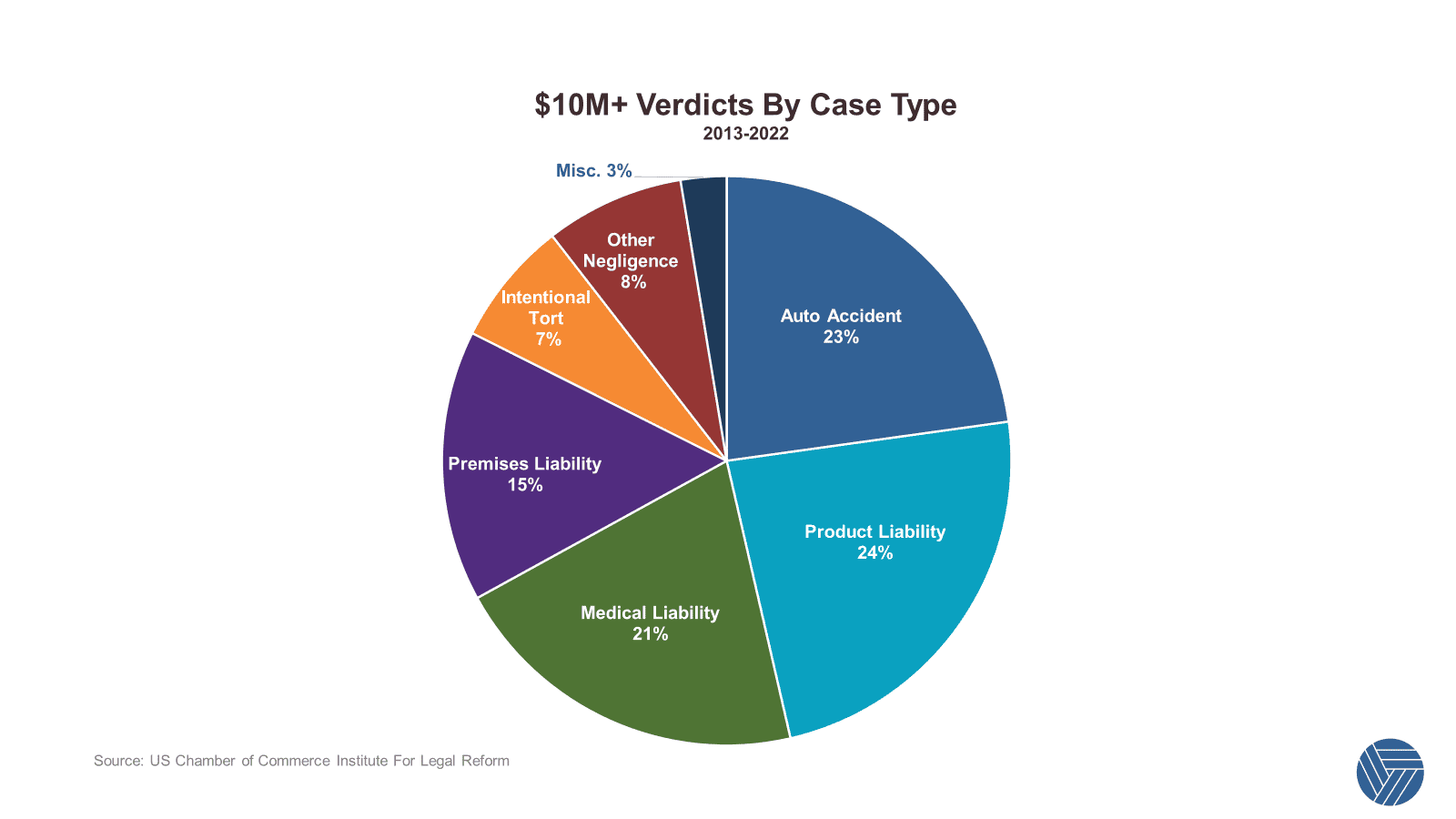

Many reported nuclear verdicts do not include a complete breakdown of each component of damages, but where available, it showed that nuclear verdicts consist primarily of awards of non-economic damages, such as pain and suffering. Consequently, the vast majority of nuclear verdicts are attributable to subjective damage assessments.

Such inflation is not free.

- Nuclear verdicts adversely affect society by driving up the costs of goods and services, inhibit job growth and new investments in businesses and industries.

- Product liability, auto accident, and medical liability cases continue to comprise two thirds of the reported nuclear verdicts.

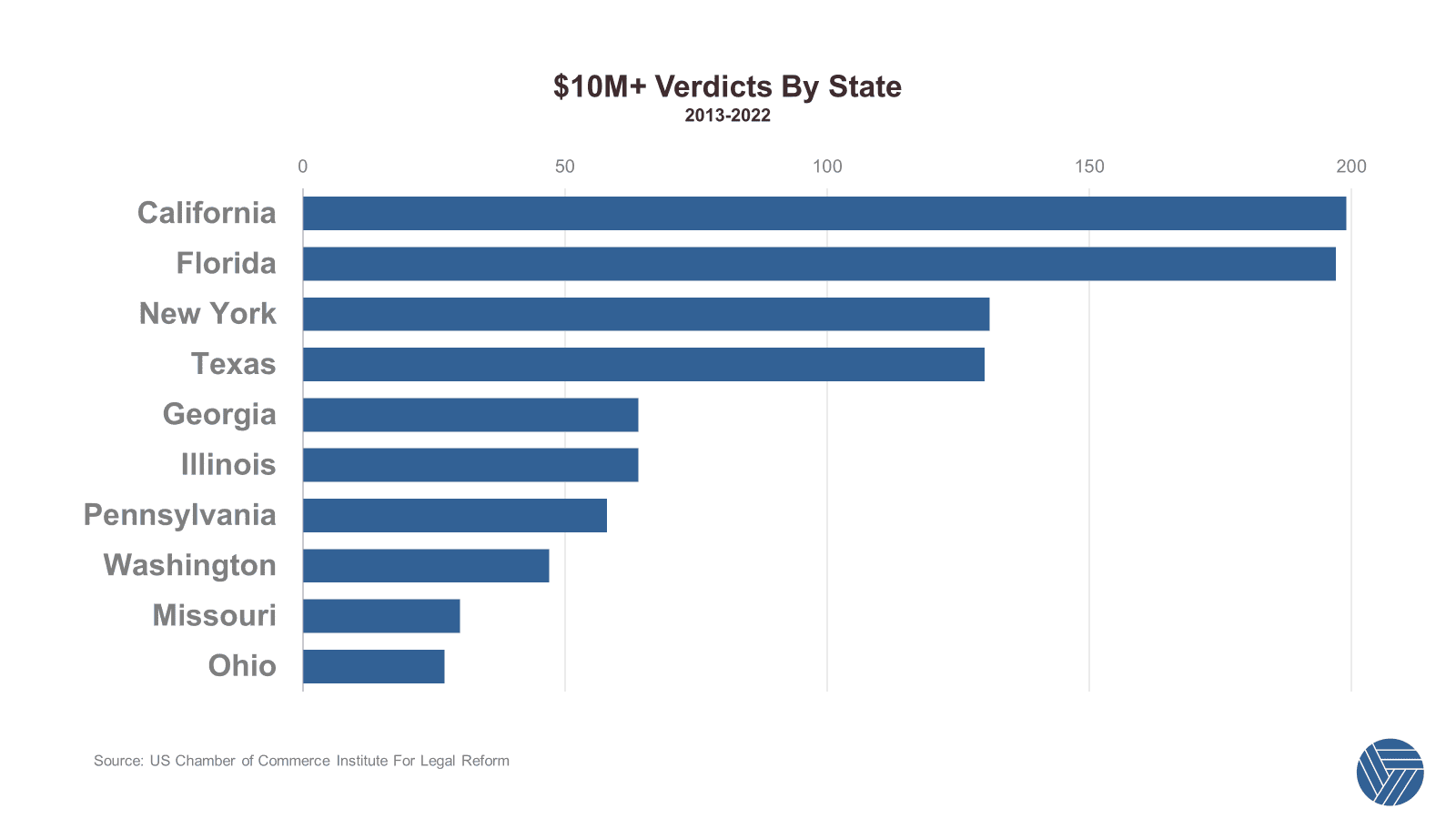

Four states—California, Florida, New York, and Texas—host half of the nation’s nuclear verdicts.

The Rise of Third-Party Litigation Funding

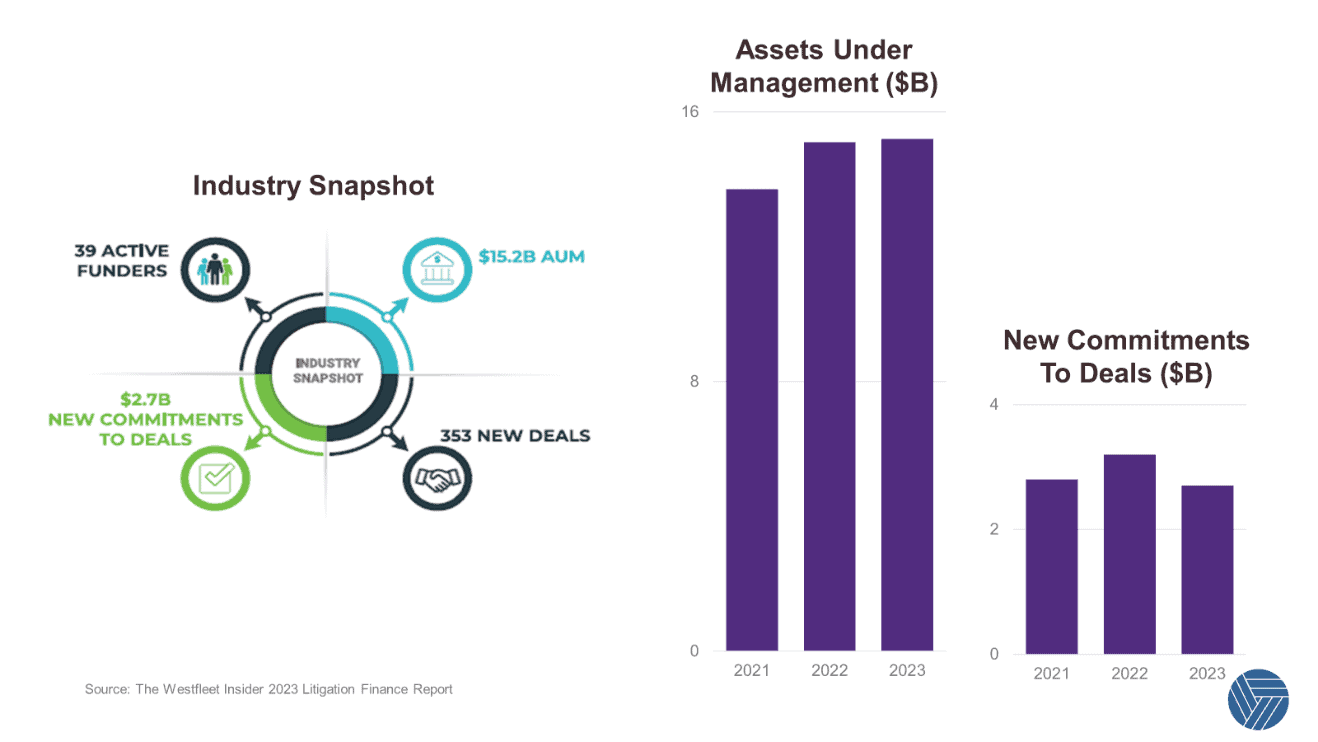

As if things weren’t bad enough, insurers must now contend with the conversion of lawsuits into investment vehicles, an alternative asset class for hedge funds and sovereign wealth funds. Such investors advance money to law firms in exchange for a share of any recoveries and view third-party litigation funding (TPLF) as a lucrative ‘uncorrelated’ investment opportunity.

This third-party funding is reshaping each part of the litigation process: which cases are brought, how long they are pursued, when and for how much they are settled. The strategies deployed aren’t necessarily aligned with the plaintiffs’ best interests, who may have preferred a prompt and reasonable settlement, rather than “gambling” on a jury trial to achieve the greatest possible return.

Much of this funding occurs behind closed doors, but clearly they provide the fuel to power the mass tort litigation machine and the growth of nuclear verdicts.

Recent Florida legislation may help to rebalance the situation. It requires the automatic disclosure of third-party funding and allows courts to consider the potential conflicts of interest such funding may cause in class actions. Such disclosure may also provide jurors with some perspective, as they consider punishing one corporation by feeding another.

Bad Faith

The plaintiff bar is using bad faith to put insurers in an untenable position. The threat of bad faith litigation is real, as is the rise of nuclear verdicts, which cause insurers to worry about their public reputation/brand. Plaintiff attorneys attempt to “set up” insurers to force them to choose between paying a larger amount to settle the underlying claim or rolling the dice on a bad faith trial. As a result, many insurers choose to settle, but the settlements are often predicated by the threat of bad faith litigation rather than the insurer’s evaluation of the underlying case. We covered this topic in last year’s Punitive Damages, ECO and XPL paper.

International Impact

Image Courtesy of Edison Wealth Management

As someone once observed, ‘when America sneezes, the world catches a cold’.

Let’s be frank, some of the limits afforded by international insurers were mind blowing in terms of quantum and it was only a matter of time before this went badly wrong.

The Champlain Towers/Securitas verdict (Florida building collapse) was recognized by many as the catalyst that introduced the reality that award levels in America are much higher than the rest of the world and, quite possibly, out of control. The tower of insurance cover for Securitas was $500M, which was paid in full to the victims. If the policy limit had been $750M, the verdict would also have matched the limit.

Many overseas territories scratch their heads at the low bar for negligence and extreme awards that exist in the U.S. In a similar vein, American domestic insurers scratch their heads at the insurance limits overseas insurers continue to offer.

Who is correct? Ultimately, we do not require an answer to this question, we simply need to recognize the litigious nature of the U.S. Underwriters wouldn’t ignore a physical exposure such as PFAS or Asbestos, so why ignore a different claims culture? It is sensible to manage this by pricing appropriately and providing smaller limits for the U.S. domiciled exposures within an overseas placement. Even better, is a complete separate tower for U.S. coverage, allowing those more familiar with the landscape to price and manage the exposures accordingly. Worryingly, we have recently seen requests to do the reverse and collapse the U.S. coverage into the global placement!

“When I travel around the globe and talk to my counterparts at European and Asian clients, the #1 issue people talk to me about is their exposure to U.S. casualty.”

Ken Brandt (2024)

Commercial Auto

U.S. Commercial Automobile liability remains the front runner in terms of nuclear verdicts. We know there is an issue, but as an industry we are still struggling to get a handle on this. This class is somewhat easier to deal with when written as a specific Auto policy because the premium and associated losses are available for assessment of adequacy. At least we know when we are under charging! Common sense would dictate that auto coverage embedded as part of a broader umbrella or excess policy is treated in the same manner, separately priced, identified and monitored. However, if that is the case, then it is somehow getting lost in the journey to the reinsurers. Many casualty reinsurance programs have seen challenging results, with most of them plagued by frequency and severity of auto claims in general liability covers.

The following information would assist to differentiate your underwriting offering to the wider market:

- underwriting guidelines and limitations that apply

- separately identify the auto premium and claims within umbrella and excess policies

- changes implemented for auto within a wider casualty offering?

Underwriting Opinion

There is no doubt that the market turned a blind eye to the soft market conditions in underwriting years 2015 to 2019. The premium levels were too low, and limits were too high, particularly from overseas risks containing U.S. domiciled exposure. Lessons have been learned the hard way for most and limit deployment has significantly contracted, accompanied with equally significant price increases. Ordinarily, a combination of the two should be enough to stem the tide and return the market to profitability. However, we are in unprecedented times, and is it questionable whether enough has been done to keep pace with the heightened inflation and the U.S. legal system.

The quick flurry of punches from recent heavyweight verdicts (Mitsubishi Motors, Real Water, Charter Communications, 7- Eleven) should dampen any enthusiasm derived solely from increased premiums and reduced limits.

Most overseas insurers continue to write U.S. domiciled exposures with the overwhelming majority coming from non-U.S. parented entities. However, the limits afforded remain considerably higher than U.S. domestic Insurers, likely a result of reinsurers taking the lions share of the risk through excess of loss placements.

In Conclusion

It would be foolhardy for U.S. insurers to think that 2015 to 2019 underwriting years were an aberration that is now resolved. Only through disciplined attachment point management and limit utilization, coupled with rate increases that outpace loss trend by a significant margin will the industry achieve reasonable returns. Anything else is akin to leading with your chin.

In conclusion, 2024 underwriting year has a fighting chance to achieve profitability, if:

- limit utilization remains tight

- original rates continue to increase by double digits (15%+ in areas such as umbrella)

- auto exposures within umbrella and excess policies receive further scrutiny

- quota share structures are transparent and contain sensible overrides

Let’s just hope we do not get undone by another sucker punch!

Contacts

Legal

Reproduction in any form without permission of TransRe is prohibited. The material and conclusions contained in this document are for information purposes only and TransRe offers no guarantee for the completeness of its contents. Statements in this document may provide current expectations of future events based on certain assumptions. These statements involve known and unknown risks, uncertainties and other factors which are not exhaustive. Although TransRe makes reasonable efforts to obtain information from reliable sources, TransRe does not guarantee the accuracy or completeness of the information given or any forward-looking statements made. TransRe undertakes no obligations to revise or update any statements, whether as a result of new information, future events or otherwise, and in no event shall TransRe or any of its affiliates or employees be liable for any damage or loss arising in connection with the use of the information relating to this document.