TransReView

US Public D&O

Insurance Market Report

December 2023

“Those who will not face improvements because they are changes, will face changes that are not improvements.” - Charles Thomas Munger (1924-2023)

ANALYSIS

We sell a product before we know our cost of goods sold, and our prices reflect both experience and expectations.

Which is why we are confused by the US Public D&O Insurance market.

We applauded (and supported with capacity) the thirty months of cumulative price rises between 2019 and mid-2022. They were a necessary correction for earlier losses.

We don’t fully understand the subsequent eighteen months of price erosion. The market has become susceptible to dramatic fluctuations, a volatile, boom-and-bust market untethered from empirical data and unhindered by logic.

We hear various defenses for the most recent bout of price deterioration, none of which fully explain or justify it:

New capacity was attracted by the booming IPO/SPAC/deSPAC business. When that dried up, the new capacity deployed to other public D&O business, driving prices down.

The rapid expansion of that premium-rich business did draw in new capacity which, when SPACs dried up, deployed to the higher layers of large towers where the barriers to entry are fewer: writing working layers is more labor intensive, requiring detailed policy forms and dedicated claims teams.

However, we have excluded IPO/SPAC/deSPAC business from our price index, to avoid obscuring the overall trend downwards

The price rises of 2019-2022 are sufficient to deliver significant profits (2021 in particular) and improve the collective projected loss ratios.

In other words ‘we can afford to give some back’. However, our sale price requires a margin for error as well as a margin of return. Those thirty months of cumulative price rises corrected the cumulative erosion between 2015-2018, and it is too early to give back those hard-won recent gains.

Collectively we have been unable to deliver consistent, profitable returns for many years. 2021 is more likely an aberration than a trend, especially after the price cuts

We are generating a lot of investment income on this long tail business

Cashflow underwriting rarely ends well, and we must price for an underwriting margin throughout the cycle. Interest rates can change quickly: markets currently anticipate they will start to drop in 2024.

There are fewer security class action filings

The frequency of filings is off 2019 highs but remains at or above historical averages. We remain concerned about dismissal rates going down, as better-targeted plaintiff filings build stronger cases. The SEC’s new Cyber Security Rules also create the potential for additional public D&O claims.

In terms of severity, elevated stock-market levels create the potential for larger $ drops

-

The rate of price declines is slowing

True, but getting worse more slowly is not the same as getting better.

Prices are still above 2018 levels.

We have seen some 200%+ loss ratios for that year. If 2018 is your benchmark, how is it working out for you?

The problem is not just because of new capacity and fewer SPACs. We all claim to be bottom-line focused, but some of us seem more top-line focused than others, as our detailed data will demonstrate.

DATA

Our perspective is based on four separate but related datasets: price changes, loss ratios, schedule P and large losses. All point to the same conclusion:

PRICE CHANGE ANALYSIS

If we continue as we are, then it is a question of when, not if profits will disappear, as a look at projected loss rations will confirm.

Source TransRe Data

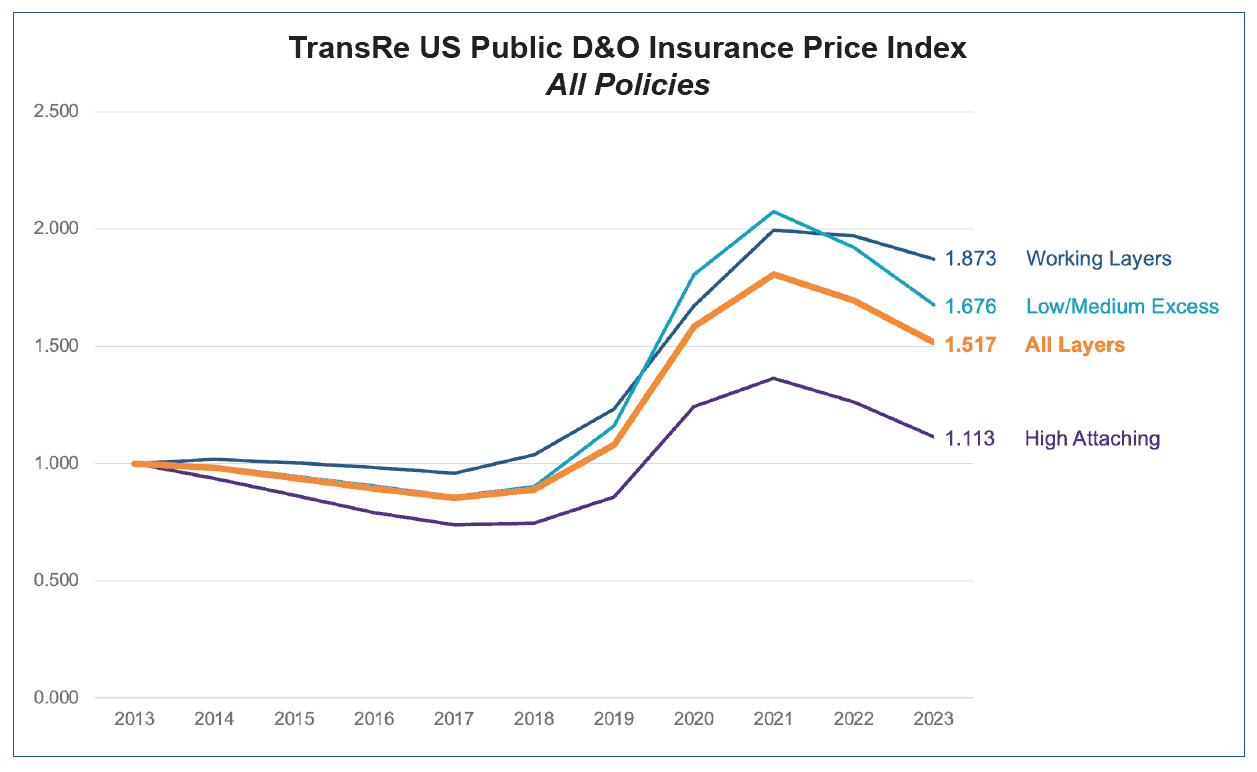

Working Layer 1.873

Low/Medium Excess 1.676

All Layer 1.517

High Attaching 1.113

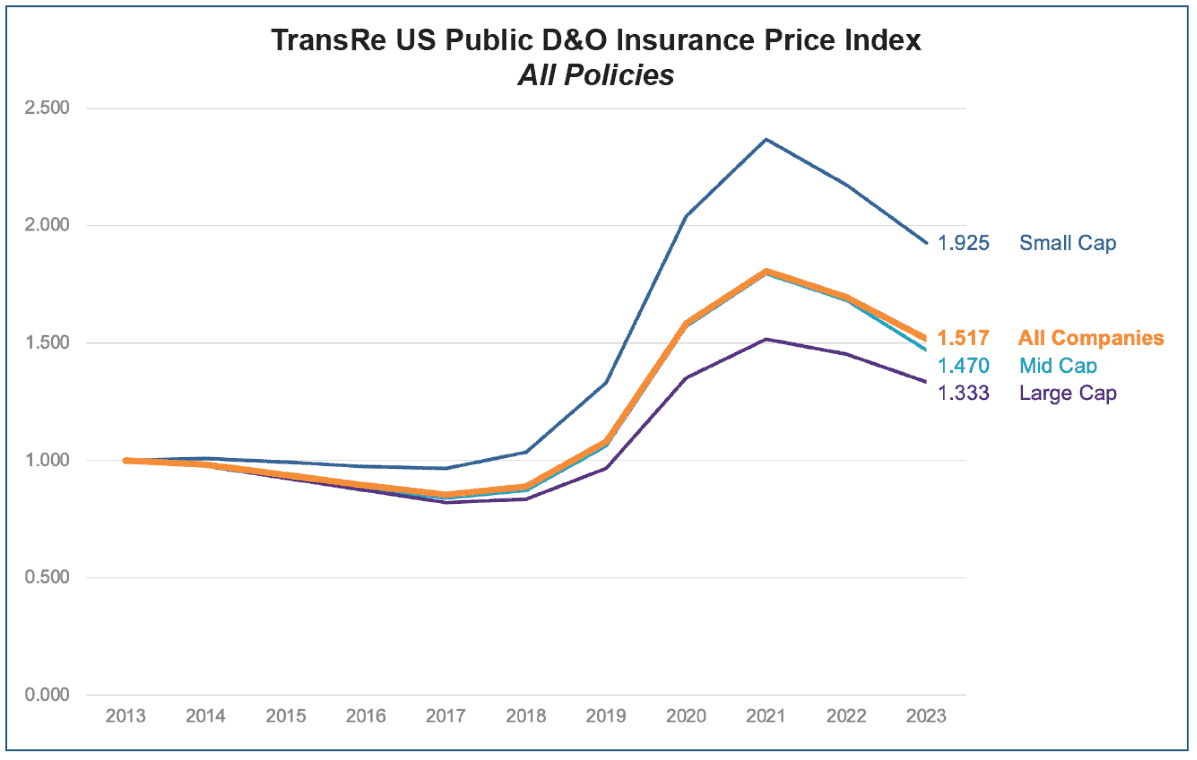

Small Cap 1.925

All Companies 1.517

Mid Cap 1.470

Large Cap 1.333

Flat

Price Increa

Price Decrease

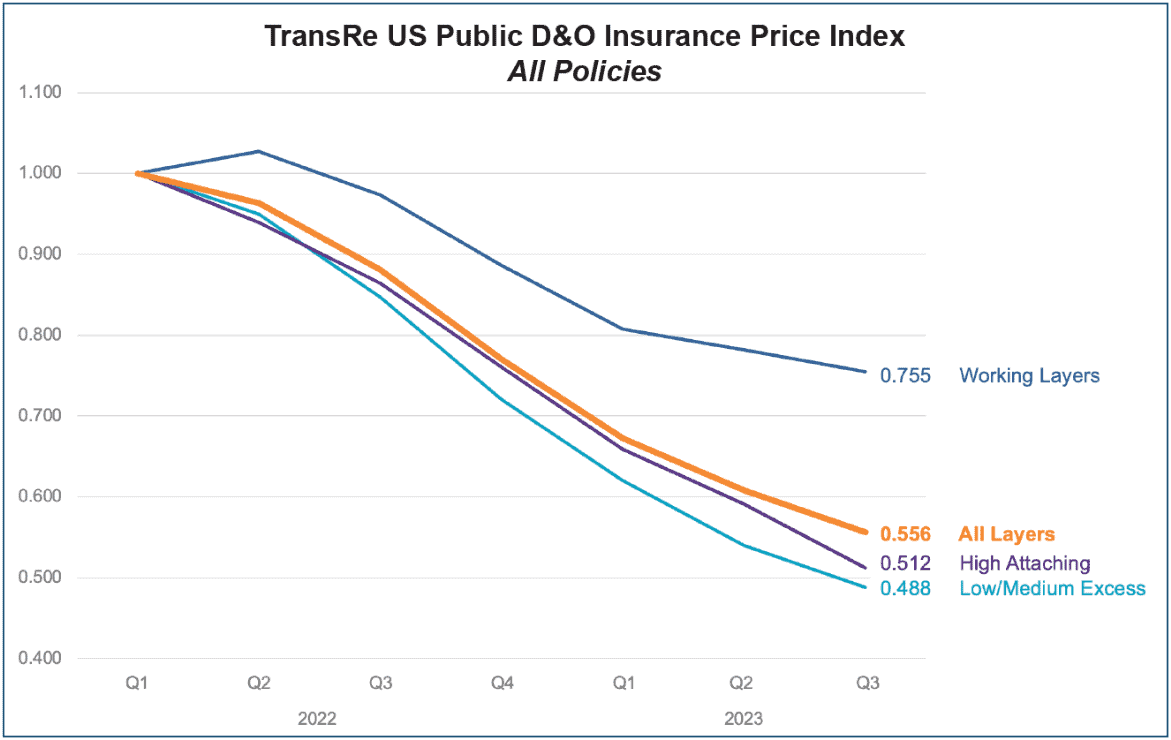

Working Layer 0.755

Low/Medium Excess 0.556

All Layer 0.512

High Attaching 0.488

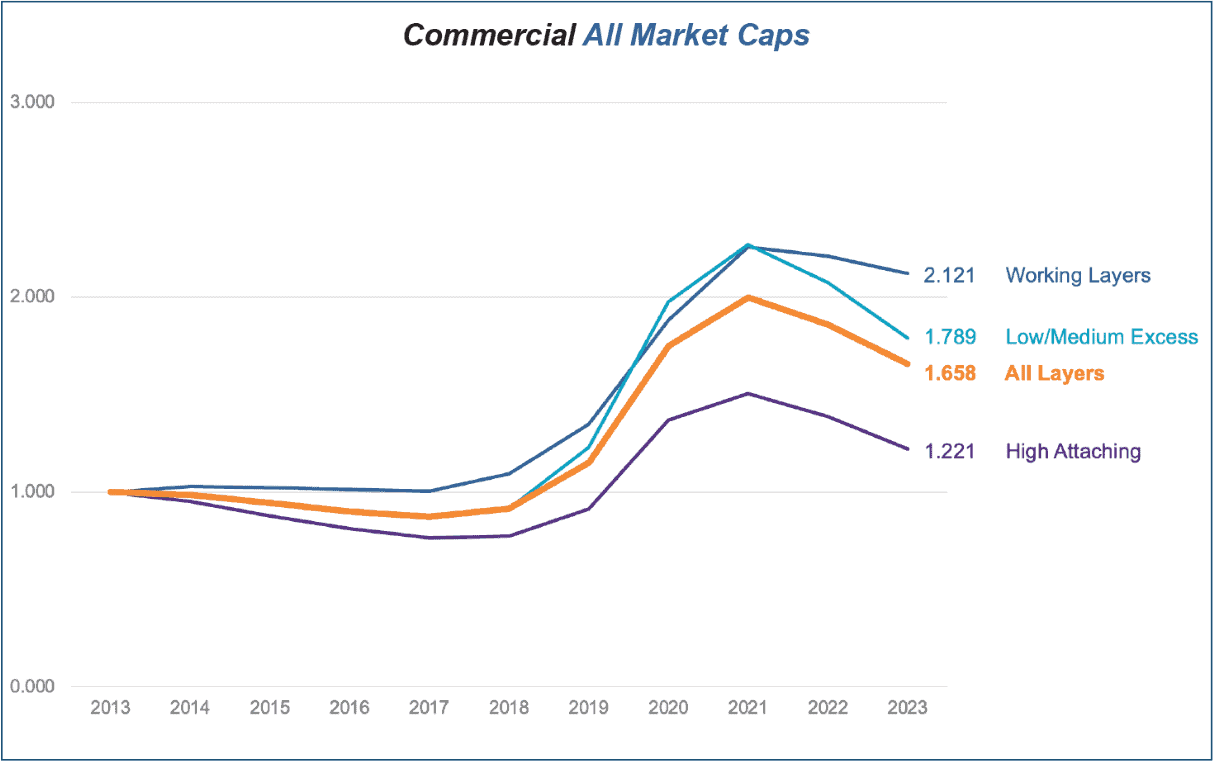

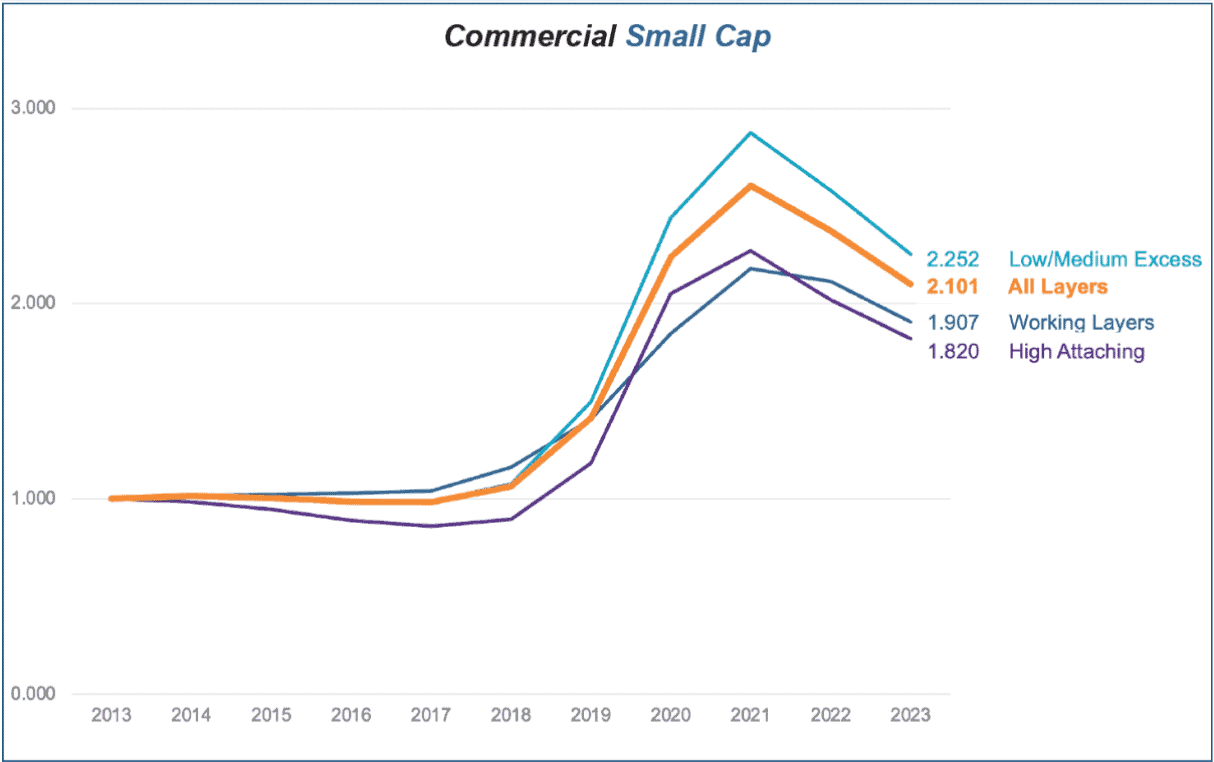

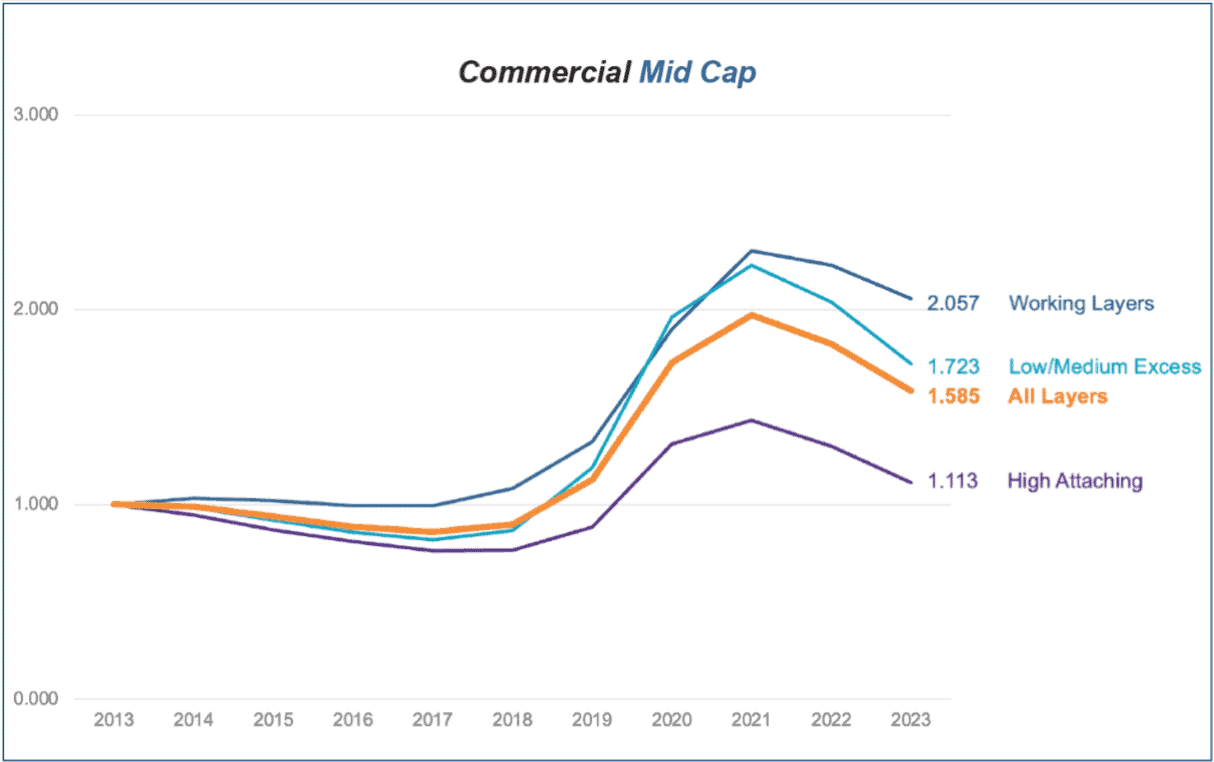

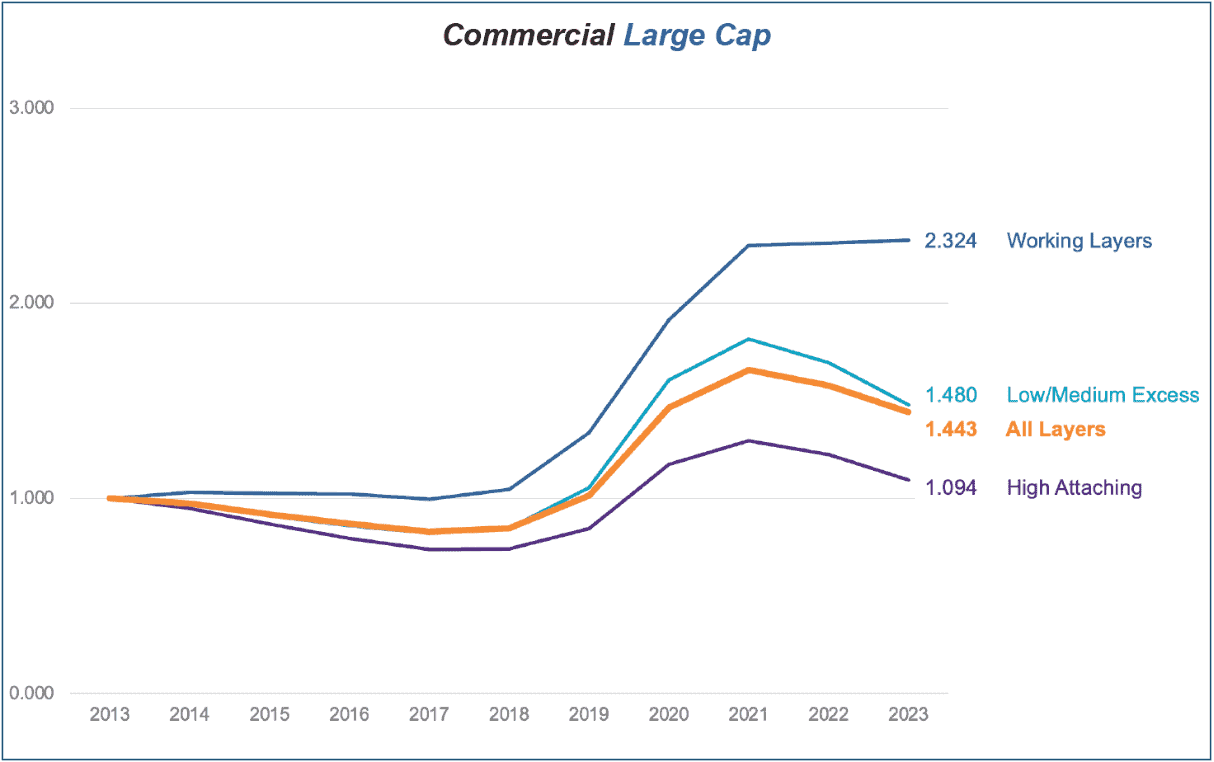

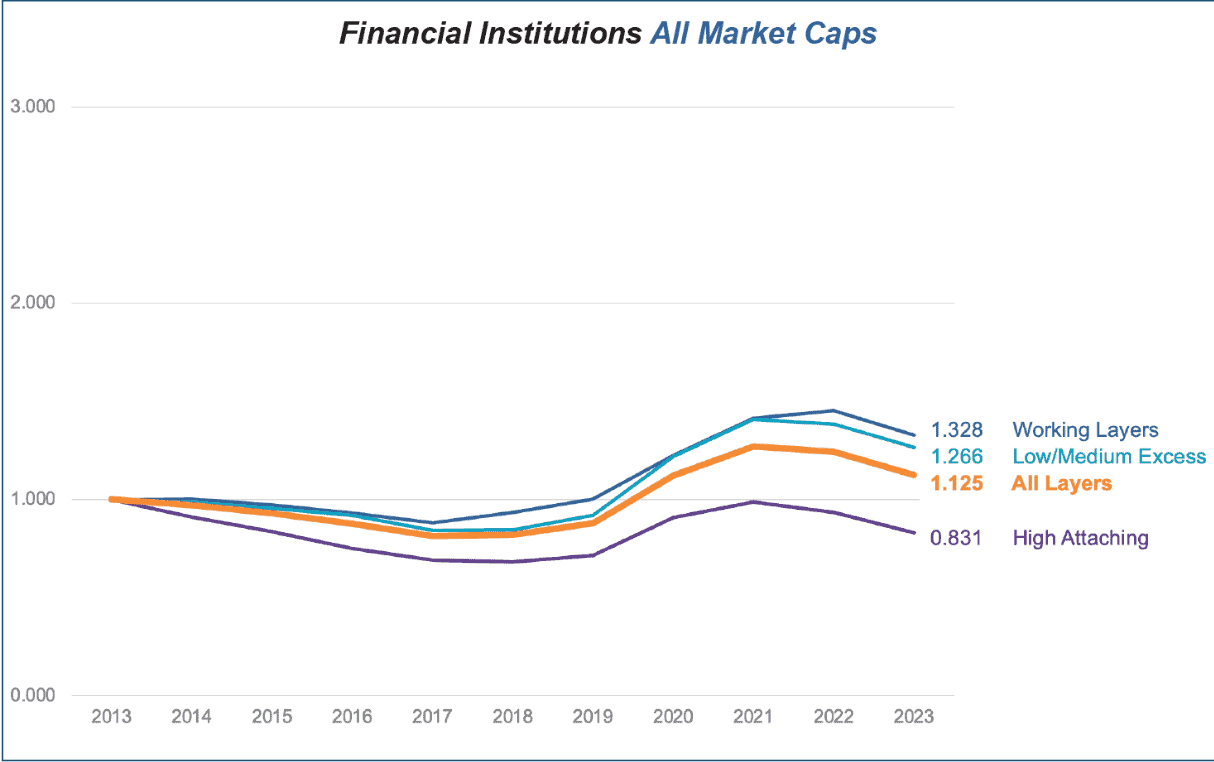

The last cycle bottomed out in 2018 after which prices rose (in response to deteriorating results) until mid-2022.

Since then, alarm bells have been ringing, across all company sizes and attachment bands.

The price for high attaching insurance gives most concern. In a severity driven line of business there is no sound reason for higher-layer pricing to be so out of step, even if new capacity is to blame.

These are nominal changes. Even before adjusting for the increasing loss cost trends, high attaching layer prices overall are only 11% higher than they were in 2013. The world is more than 11% riskier than it was a decade ago.

Having risen most in 2019-2022, small cap companies have since retreated fastest.

Although large cap business appears to be holding price better overall, such business rose the least during the upswing and the price of high attaching layers dropped in 2022, despite being a major source of claims, and despite those layer prices having also lagged behind the 2019-2022 upswing.

If we remove Financial Institutions from the dataset, the decline in Commercial prices is more evident and more severe.

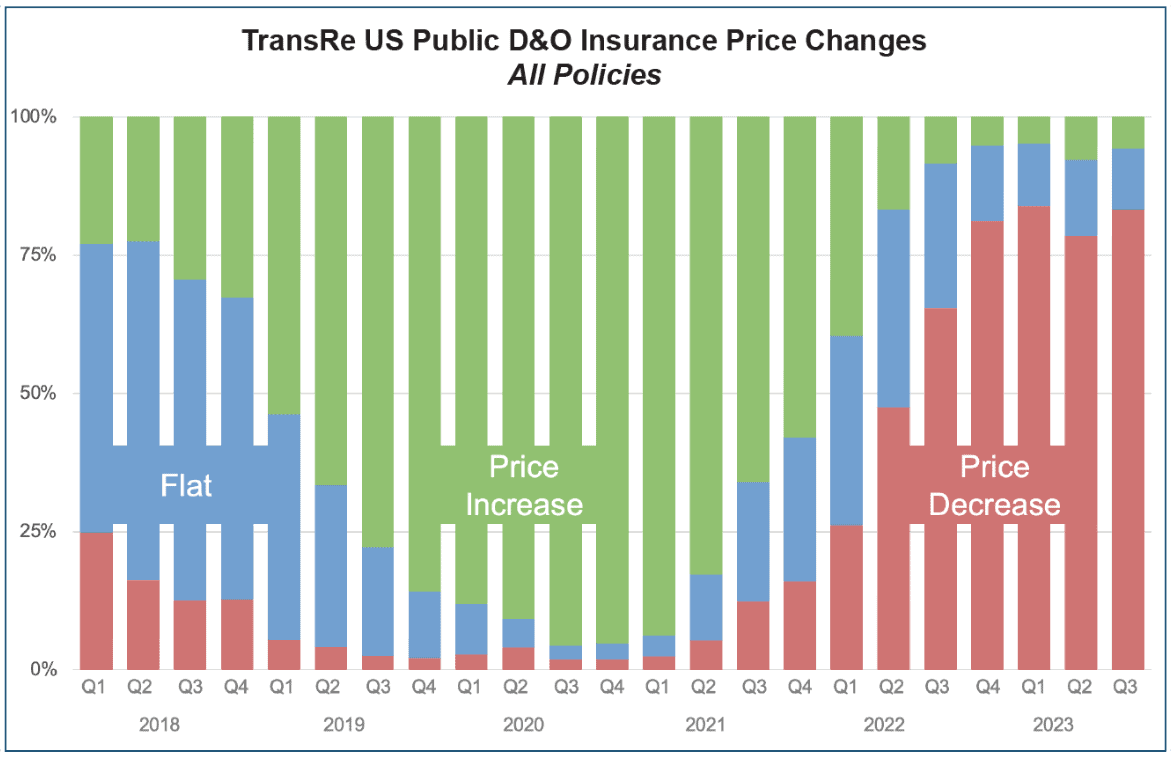

The most widespread price rises were in 2020

A majority of renewals have declined in price each quarter since Q3 2022.

At times of market inflection, relatively few policies renew flat/‘as is’. Now appears to be one of those times.

When we focus on price changes from the peak (Q1 2022), the dramatic price decline is evident.

Again, it is the higher attaching layers that are of most concern

While the decline is slowing, prices continue to deteriorate

LOSS RATIO ANALYSIS

The math of D&O insurance is straightforward:

| Combined Ratio | 100% |

| Assume Acquisition Costs | (15%) |

| Assume Internal Expenses | (15%) |

| Breakeven Loss Ratio | 70% |

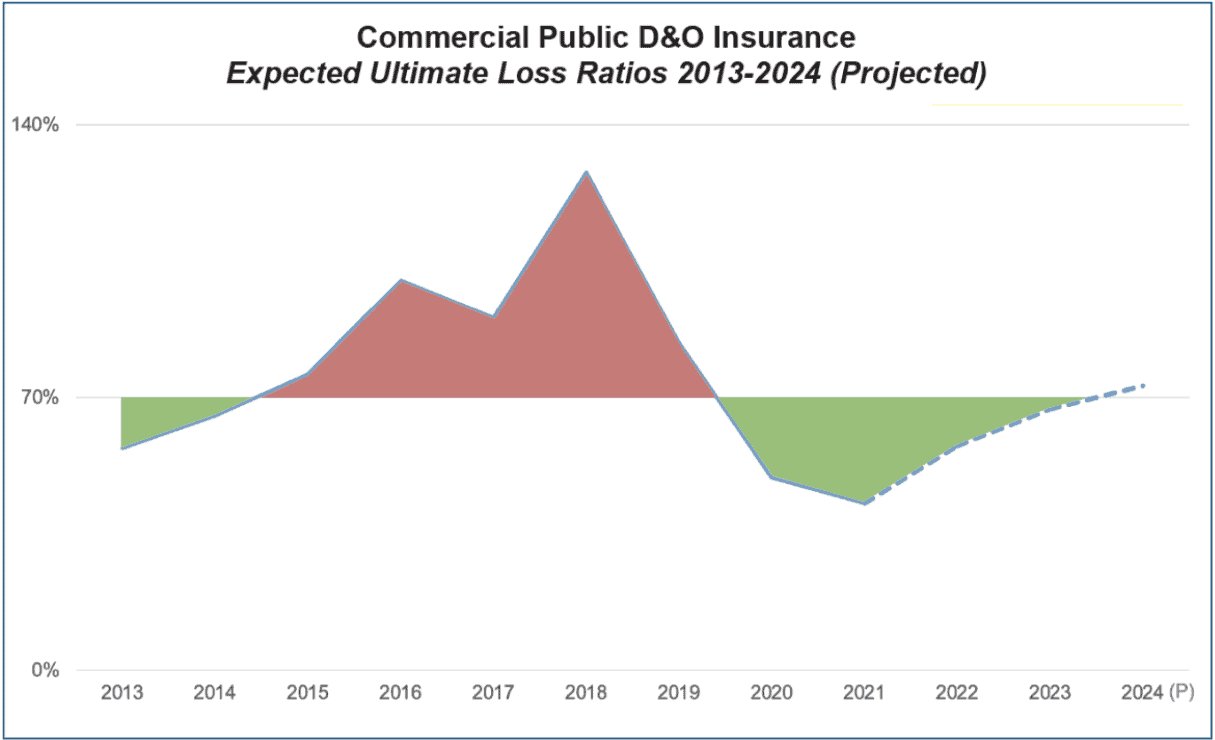

We have superimposed this notional breakeven on expected Commercial ultimate loss ratios:

We are giving away price on the back of recent (but underdeveloped) positive experience, without seeming regard for the continuing adverse development of earlier years, as our Schedule P analysis underlines.

Source TransRe Data

2021 is the most recent year sufficiently developed to provide an accurate data point. Up to then the picture appears fine.

However, collectively US public D&O writers failed to achieve their anticipated rate rises in 2022 and this miss is already impacting results, even before 2023’s price freefall.

Only four of the past fifteen years show an expected profit, and three of those are the most recent (least developed) years.

Continuing price decreases into 2024 turn the projection negative.

The cumulative, notional (yet to be crystalized) profits of 2020-2023 (area under the line) is smaller than the prior period’s losses (area above the line). If realized, this would represent an overall market loss for the cycle.

SCHEDULE P ANALYSIS

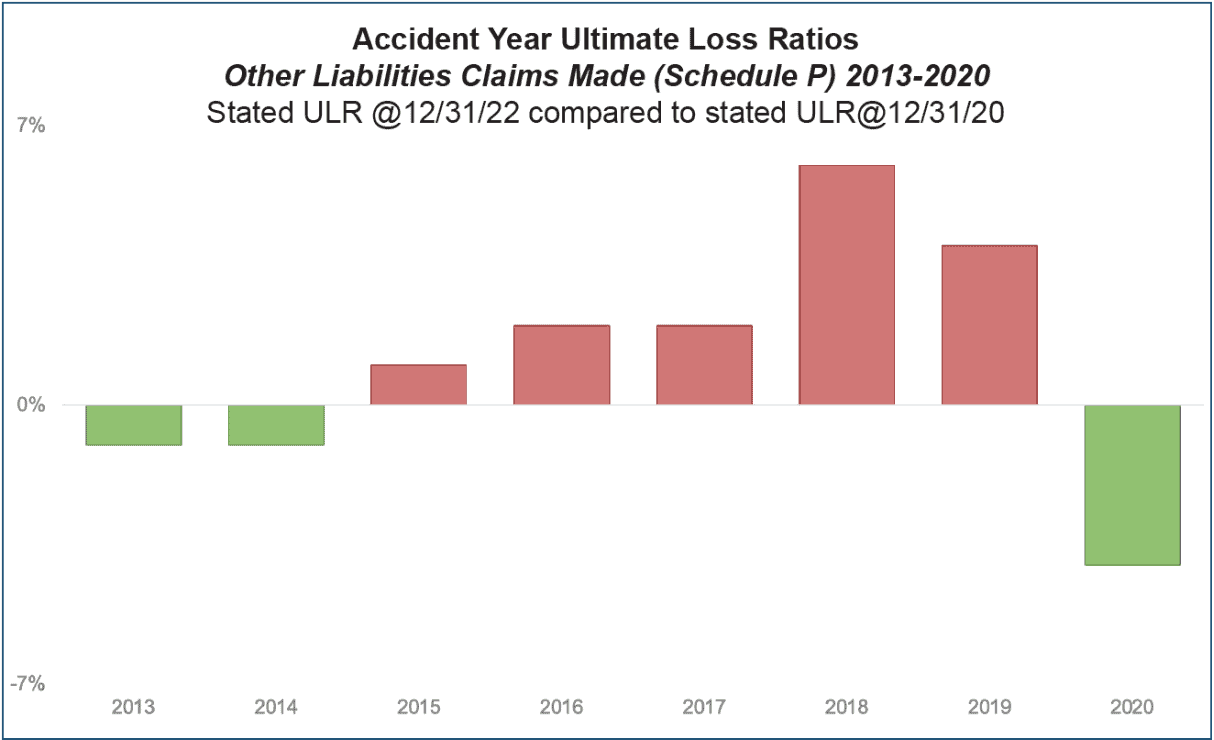

The Other Liability Claims Made data in Schedule P of Annual Statements (Yellow Books) provides a proxy for D&O, since it also includes E&O, Environmental, Product Liability, Cyber and Transactional business.

To highlight the ongoing development, we compared the accident year loss ratios reported at the end of 2022 against those reported at the end of 2020:

Those who believe rates are currently adequate must also believe that no further deterioration will occur

Source TransRe Data

The ongoing and significant upward restatement of 2016-2019 losses is clear.

The deterioration in 2018 alone is equivalent to $1B.

Based on currently available data 2020 looks positive….so far, as the anticipated post-Covid surge of claims has failed to materialize.

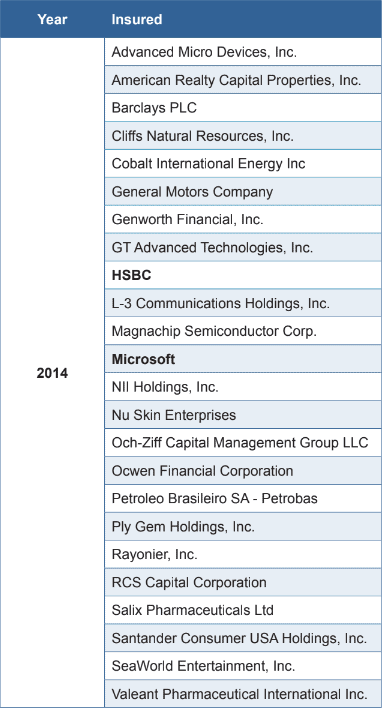

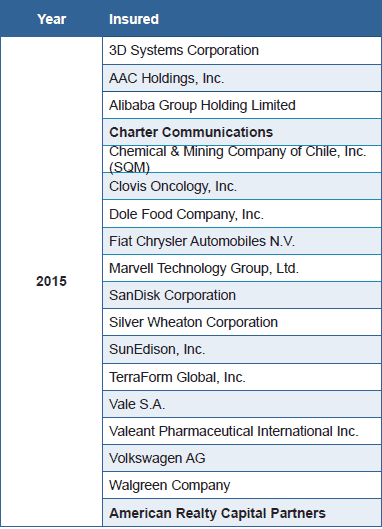

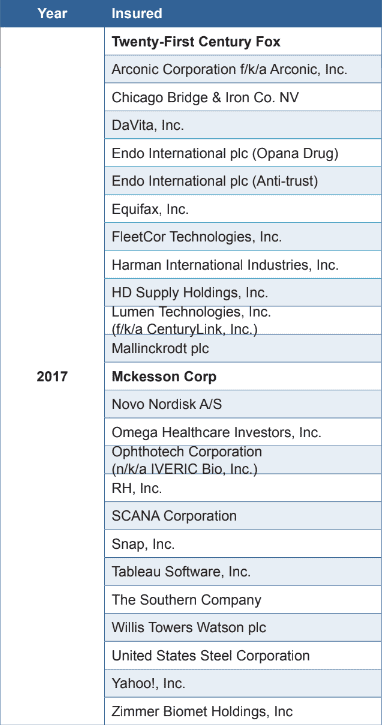

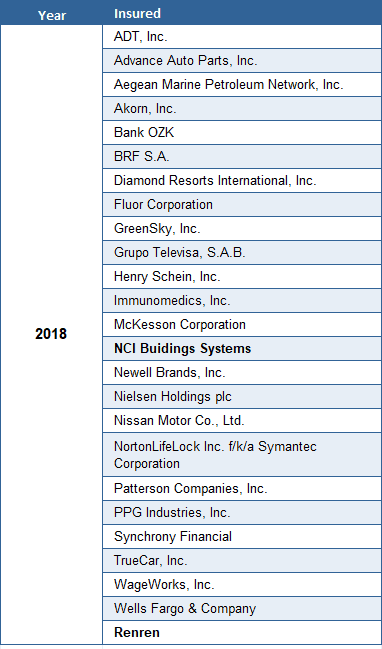

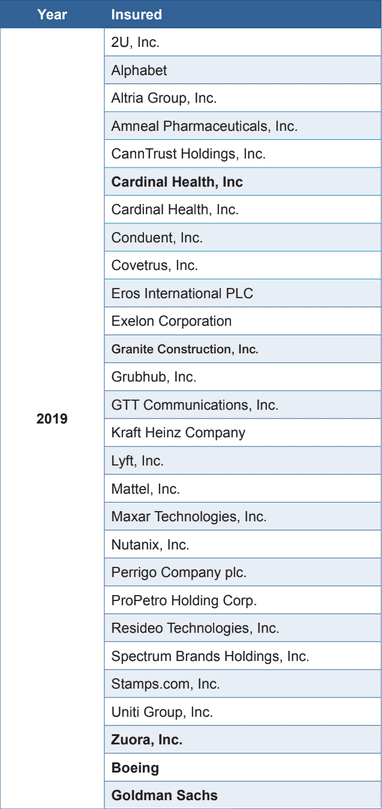

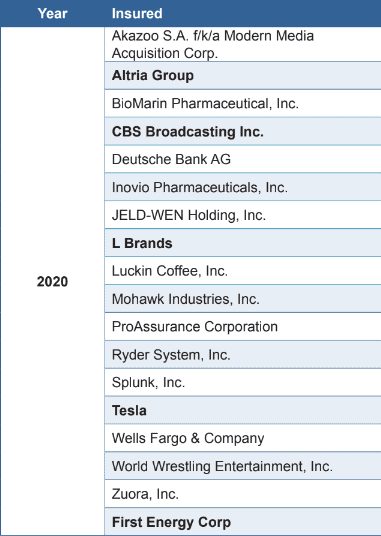

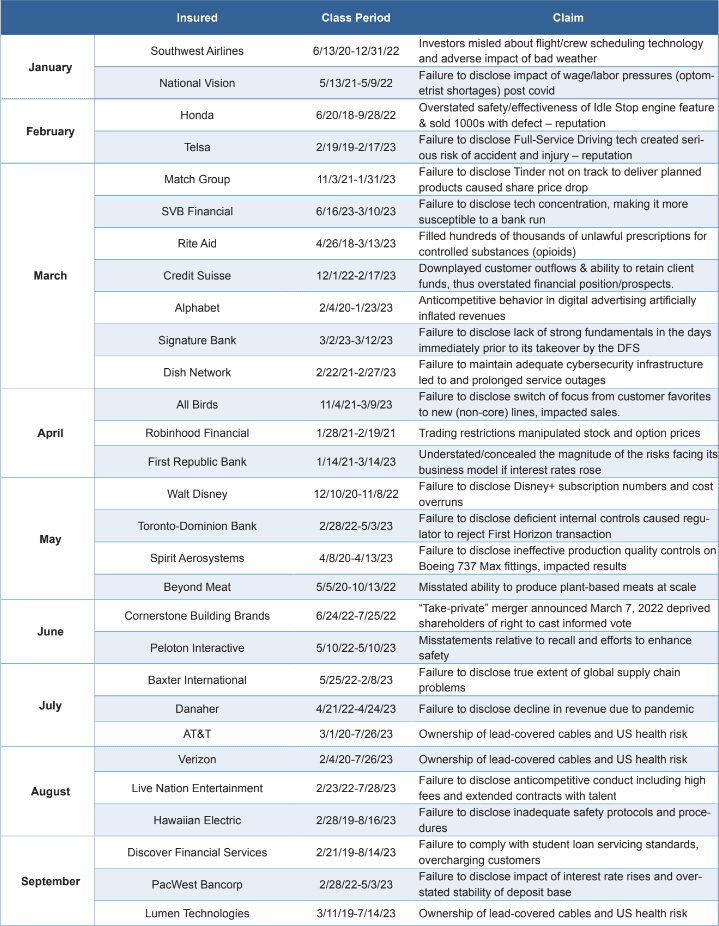

LARGE LOSSES

We track all significant ($25M and above) settlements, both directly and through the work of the Stanford Law School Securities Class Action Clearinghouse and Cornerstone Research. (Our case data, by year of settlement and split between securities class actions and derivative suits, is available online as an appendix to this report. So too are our ‘2023 filings of interest’).

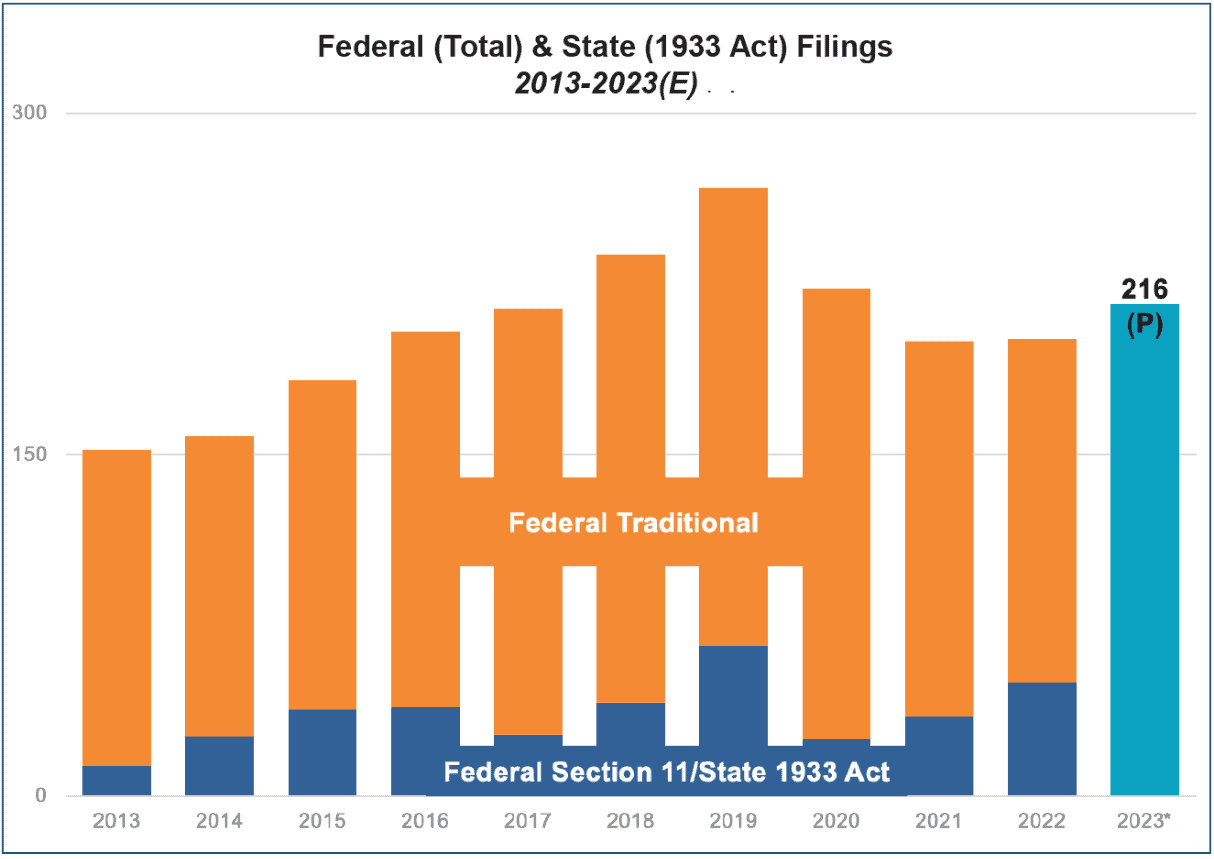

To enable a like-for-like analysis, we have removed merger objection claims from the Clearinghouse chart since they are now typically styled as individual actions rather than federal class actions.

Sources 2013-2022: Cornerstone Research and Stanford Law School Securities Class Action Clearinghouse, Bloomberg Law, Institutional Shareholder Services’ Securities Class Action Services, 2023*: TransRe projection.Core filings (excludes merger objection claims).

Source TransRe Data

Frequency – we project 216 filings for 2023 (198 through 11/23) which, if accurate, would make 2023 the fourth highest year for such claims in the past decade.

Severity – data points to note include:

- 1H 2023 - 8 mega DDL filings (>$5B), double the 1997-2022 annual average.

- The rise in median investor losses (as defined by NERA) to $972M in 2022, 33% higher than 2021

- The rise in Cornerstone’s DDL index to $170B in 1H2023, 45% higher than 2H2022

- More large (>$50M) derivative settlements impacting Side A

We are monitoring whether more focused filings are reducing dismissal rates

The recent downward trend in frequency has halted, if not yet reversed.

TO CONCLUDE

It isn’t easy to raise prices when we’re making money, but it should be possible to hold prices when we’re not yet sure how much we’ve made. We have sympathy for underwriters confronted with demands for price cuts, but the risk outlook makes it troublesome to justify or support.

The significant price improvements between 2019 and mid-2022 were a necessary correction for the preceding years.

Premium is leaving the market faster than warranted. The impact is already materializing in projected loss ratios. We must price for an underwriting margin, irrespective of interest rates.

Newer players may have clean balance sheets and expenses to cover, but they will soon have their own claims to pay.

The market is inadequately priced. What will your New Year’s resolution be?

Legal

Reproduction in any form without permission of TransRe is prohibited. The material and conclusions contained in this document are for information purposes only and TransRe offers no guarantee for the completeness of its contents. Statements in this document may provide current expectations of future events based on certain assumptions. These statements involve known and unknown risks, uncertainties and other factors which are not exhaustive. Although TransRe makes reasonable efforts to obtain information from reliable sources, TransRe does not guarantee the accuracy or completeness of the information given or any forward-looking statements made. TransRe undertakes no obligations to revise or update any statements, whether as a result of new information, future events or otherwise, and in no event shall TransRe or any of its affiliates or employees be liable for any damage or loss arising in connection with the use of the information relating to this document.

A Note About Our Data

Our analysis of the lawyers’ liability market is based upon the insurers we serve, and the data we receive. As a result, the underlying data is not identical to last year’s analysis. Large law firms are predominantly insured by carriers that write in multiple states and focus on firms with 25 or more attorneys. Our analysis therefore excludes data from mutuals, captives and risk retention groups.

About Our Database, Methodology, Sources

1. Over decades (and billions of premiums and corresponding claim payments) we have accumulated significant management and professional liability data and insights. We supplement this with licensed third party data and publicly available information, combined into our proprietary analytics engine.

2. Our database includes details of 30,000+ policies.

3. To deliver our analysis we separate Financial Institutions from Commercial, which we further sub-divide by company size and attachment point:

| Attachment Bands | |||

|---|---|---|---|

| Working | Medium | High | |

| Small Cap (<=$1B) | 0 | <$25M | >=$25M |

| Mid Cap (>$1B - <$10B) | <=$10M | >$10 to <$50M | >=$50M |

| Large Cap (>=$10B) | <=$20M | >$20 to <$100M | >=$100M |

4. Our report excludes IPO, SPAC and deSPAC data (where identifiable): the rapid growth then drop in these high-premium programs would otherwise unduly affect general trends.

5. We have focused on price rather than rate, to exclude (untrackable) changes in coverage.

6. In addition to general (CPI) inflation, we closely monitor two specific types of inflation which directly impact management liability:

a. Legal service inflation (LSI) which impacts loss adjustment expenses. According to the US Bureau of Labor Statistics) LSI was 6.6% for 2022 and 3.6% thru June 2023 (10-year average is 2.1%).

b. Underlying loss cost trend (not just defense costs) which reflects increased severity as the plaintiffs’ bar pursues fewer but more likely cases and asks for more.

7. We only include the business we see. While we believe this to be a majority of what is available, it is not the entire market.

Sources

In addition to publicly available data and our own insights, our third-party data comes from a combination of FactSet, Stanford Securities Litigation Analytics, Stanford Law School Securities Class Action Clearinghouse, The D&O Diary, SNL and National Economic Research Associates (NERA), whose work we gratefully acknowledge. To maintain our claims database, we actively monitor major suits and their outcomes.

TRANSRE US PUBLIC D&O INSURANCE PRICE INDICES

Source TransRe Data

Source TransRe Data

Source TransRe Data

Source TransRe Data

Source TransRe Data

SIGNIFICANT (>=$25M) SETTLEMENTS D&O , BY YEAR OF FILING

Derivative suits are bolded and underlined – the balance are securities class actions.

Current Watchlist: 2023 Cases of Note

About Us

Underwriting D&O/E&O Treaty

- Brian Finlay

bfinlay@transre.com - Stuart Alford

salford@transre.com - George Delaney

gdelaney@transre.com - Daniel Hojnowski

dhojnowski@transre.com - Bill Seymour

wseymour@transre.com - Deirdre Zeppie

dzeppie@transre.com

Actuarial Science

- Joe Marracello

jmarracello@transre.com - Lily Harger

lharger@transre.com

Questions,

comments or

feedback?

To discuss any aspect of this report, or your ongoing US Public D&O reinsurance needs, please reach out to any member of the production team:

Portfolio Management

Elise McKenzie, Anthony Matteo, Ben Casey

Underwriting

Daniel Hojnowski, George Delaney, Diana Liu, William Seymour, Matthew Yuen, Deirdre Zeppie, Lonny Agulnick (Fac)

Actuarial

Joe Marracello, Kevin Peterson

Claims

Seth Goldberg

You can also reach us at Communications@transre.com